Transformative Trends in Malaysia’s Finance and Accounting Sector

The Finance & Accounting sector in Malaysia is experiencing a paradigm shift driven by rapid digital transformation. As firms embrace cutting-edge technologies and adapt to evolving regulatory landscapes, they are redefining efficiency and innovation.

This section explores the key trends and advancements propelling the industry forward, highlighting how companies are navigating these dynamic changes to thrive in a competitive global market.

Digital Transformation and Technological Advancements

The shift towards automation and data-driven decision-making has led to increased efficiency and accuracy in financial processes.

Key technological advancements driving this change include the adoption of cloud computing, artificial intelligence (AI), and blockchain technology.

Cloud Computing

Cloud computing has revolutionized the way financial data is stored, accessed, and managed. It offers scalable solutions that allow firms to handle vast amounts of data with greater flexibility and security.

Cloud platforms facilitate seamless collaboration among stakeholders, enabling real-time data sharing and analysis.

Artificial Intelligence (AI)

AI has become a crucial tool in the finance and accounting industry. It automates routine tasks, such as data entry and reconciliation, freeing up professionals to focus on more strategic activities.

AI-powered analytics can predict financial trends, identify anomalies, and provide actionable insights, enhancing decision-making processes.

Blockchain Technology

Blockchain technology ensures the integrity and security of financial transactions. By providing a decentralized ledger, it reduces the risk of fraud and enhances transparency. This technology is particularly beneficial for auditing and compliance, as it provides an immutable record of transactions.

The integration of these technologies has streamlined operations and improved data management. Firms can now process transactions more quickly and accurately, reducing the likelihood of errors. Enhanced data analytics capabilities allow for better risk assessment and mitigation strategies, ensuring compliance with regulatory requirements.

Shifts in Customer/Client Interactions

The rise of online banking and fintech solutions has significantly altered customer expectations. Clients now demand convenient and seamless experiences, prompting firms to prioritize digital transformation initiatives. This shift has led to the development of user-friendly platforms that offer 24/7 access to financial services, increasing customer satisfaction and loyalty.

Regulatory Environment Changes

In Malaysia, the regulatory environment for finance and accounting has become more stringent in recent years. There is a heightened emphasis on transparency and cybersecurity, with regulations increasingly aligned with international standards such as the Malaysian Financial Reporting Standards (MFRS) and International Financial Reporting Standards (IFRS).

Financial institutions and accounting firms must continuously adapt and adhere to these evolving regulations to remain compliant.

Innovative Financial Management Practices

A noticeable shift towards innovative financial management practices is evident in Malaysia, particularly in sustainability and environmental accounting. There is a growing emphasis on corporate social responsibility (CSR).

Research indicates that while CSR initiatives may not immediately impact profitability metrics like sales or return on assets (ROA), they significantly enhance corporate reputation and brand equity. This improved reputation can lead to increased stock returns and long-term financial performance.

Advancements in Financial Reporting and Data Analytics

Recent years have seen significant advancements in financial reporting and data analytics. Innovations in this area enable firms to analyse vast volumes of financial data in real-time, uncover hidden patterns, and generate actionable insights.

- Real-time data analysis: Real-time data analysis tools allow firms to make informed decisions swiftly, improving their competitiveness in the dynamic global economy.

- Cloud-based reporting solutions: Provide flexibility and accessibility, facilitating seamless collaboration among stakeholders regardless of their location.

- Interactive reporting tools: Empower stakeholders to visualize financial data and conduct ad-hoc analyses. This fosters transparency and collaboration, enabling better strategic planning and decision-making.

- Sustainability reporting tools: Sustainability reporting tools help firms assess their environmental, social, and governance (ESG) performance. These tools ensure that companies meet regulatory requirements and demonstrate their commitment to sustainable practices.

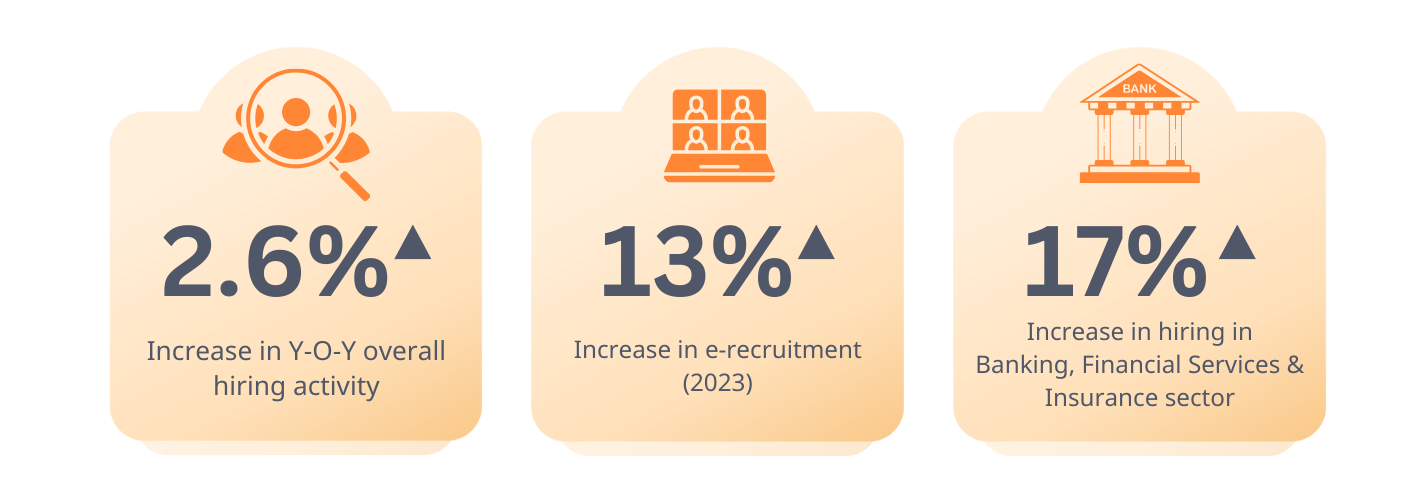

Current Job Market Insights

Malaysia’s job market has demonstrated remarkable resilience, with hiring activity inching up. With an emphasis on digital skills, there’s a growing demand for professionals with expertise in data analytics, financial modelling software, and emerging technologies such as blockchain and AI.

In-Demand Skills

Technical Skills

Soft Skills

- Communication: need to communicate complex financial information effectively

- Collaboration: need to be able to work with cross-functional teams

- Adaptability: need to be able to adapt to changing regulatory requirements and market conditions

Highly valued certifications/qualifications

- ICAEW certification

- ACCA (Association of Chartered Certified Accountants) qualifications

- CPA (Certified Public Accountant)

- CFA (Chartered Financial Analyst)

- CMA (Certified Management Accountant)

- Specialized certifications in areas such as:

- Financial modelling

- Risk management

- Internal auditing

In-Demand Roles

Emerging Roles

- Financial analysts: can analyse data and trends to provide insights for investment decisions

- Financial technology (fintech) specialist and digital banking managers: can navigate and innovate within the digital financial space

- Risk management professionals: can help companies navigate complex financial risks

From Attraction to Retention

Understanding what drives employees to stay or leave is crucial. By grasping these factors, you can create an optimal work environment that retains top talent and consistently attracts new, high-caliber team members.

Talent Attraction Strategies

Commitment to Professional Development

Attracting top talent in the Finance & Accounting sector starts with a strong commitment to professional development and career advancement opportunities.

Companies can offer specialized training programs, mentorship initiatives, and opportunities for employees to earn certifications or pursue further education. By investing in their employees’ growth, firms demonstrate a dedication to helping their team members reach their full potential.

Organizational Culture and Values

Highlighting a company’s organizational culture, values, and commitment to diversity and inclusion is essential for attracting talent. Candidates are increasingly looking for workplaces where they feel valued and respected. Showcasing a positive, inclusive work environment can differentiate a company from its competitors and appeal to a diverse pool of candidates.

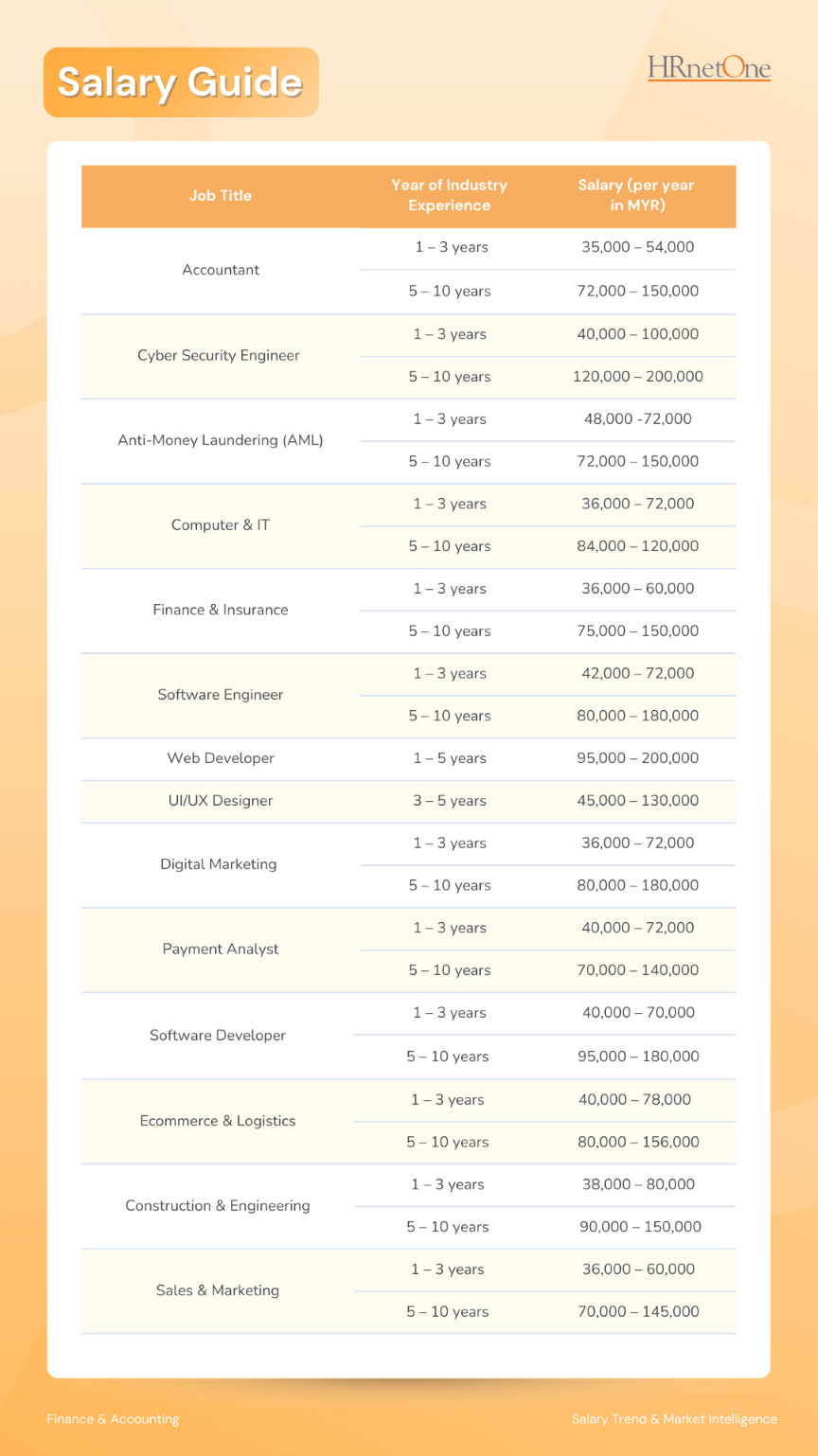

Competitive Compensation Packages

Offering competitive compensation packages is a fundamental strategy for attracting talent. Attractive salaries, bonuses, and comprehensive benefits such as healthcare plans, retirement contributions, and stock options are key incentives. These packages should be competitive within the industry to ensure that the company stands out to potential employees.

Commitment to Innovation

Showcasing a commitment to innovation and cutting-edge technologies can attract candidates eager to work on exciting projects. Emphasizing opportunities to engage with the latest advancements in finance and accounting technologies can draw in tech-savvy professionals who are keen to be at the forefront of industry developments.

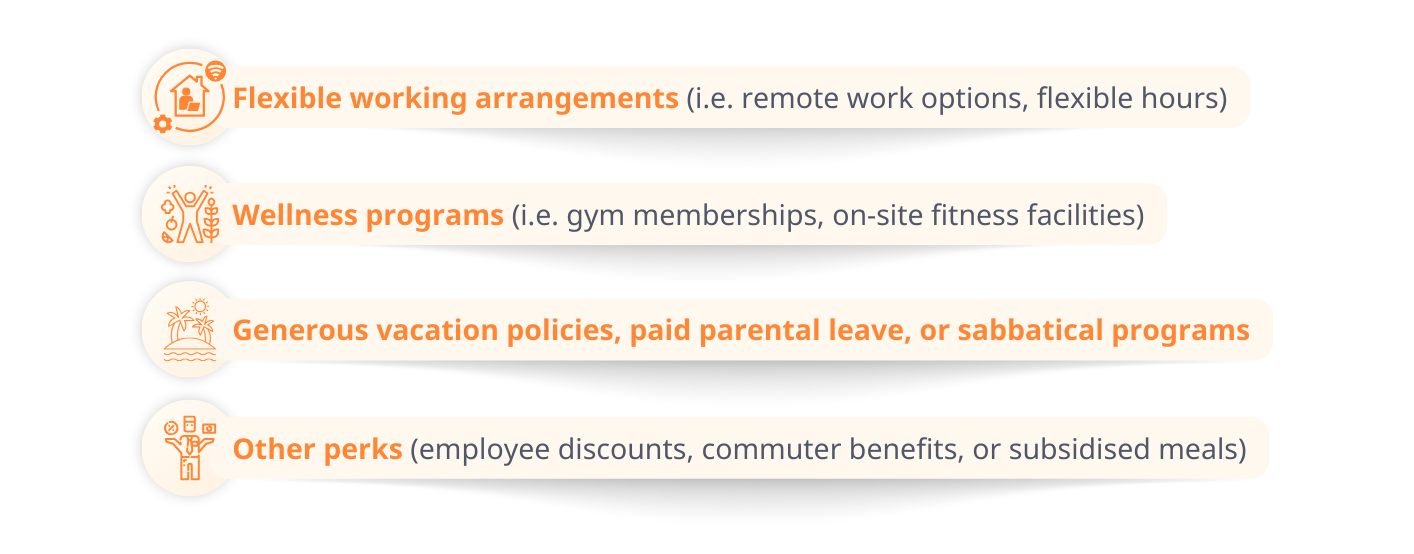

Additional Perks

Enhancing the employee experience with additional perks can make a company more attractive to potential hires. These perks may include:

Talent Retention Strategies

Communication and Transparency

Highlighting a company’s organizational culture, values, and commitment to diversity and inclusion is essential for attracting talent. Candidates are increasingly looking for workplaces where they feel valued and respected.

Showcasing a positive, inclusive work environment can differentiate a company from its competitors and appeal to a diverse pool of candidates.

Positive Work Culture

Fostering a positive work culture that values teamwork, collaboration, and recognition is crucial for employee retention. A supportive environment where employees are acknowledged for their contributions can boost morale and loyalty.

Promoting Work-Life Balance

Promoting work-life balance through flexible work arrangements, wellness programs, and employee support initiatives helps retain employees by reducing burnout and enhancing job satisfaction. Companies that prioritize their employees’ well-being are more likely to keep their top performers.

Clear Career Paths

Creating clear career paths, performance goals, and development plans helps employees understand their opportunities for advancement within the organization.

When employees see a clear trajectory for their career growth, they are more motivated to stay and achieve their objectives.

Talent Management Strategies

Implementing effective talent management strategies, such as succession planning and internal talent mobility programs, is essential for retention. Identifying and grooming high-potential employees for leadership positions or specialized roles ensures that the organization retains its best talent and prepares for future leadership needs.

Work with a Recruiter

Hiring in the Finance and Accounting sector in Malaysia comes with its unique set of challenges, including a limited pool of qualified candidates, fierce competition for high-demand roles, skills mismatches, and retention issues. Partnering with a recruiter can alleviate these burdens, allowing companies to focus on their core operations and business growth.

Recruiters bring a high level of expertise and experience in navigating the labour market, candidate screening, interviewing, and labour laws. They also have access to a vast network of high-quality talents and passive candidates, often the top performers in the industry. Collaborate with our team to streamline your recruitment process and secure the best talent for your organization.