Transformative Trends in Malaysia’s Finance and Accounting Sector

The Finance & Accounting sector in Malaysia is experiencing a paradigm shift driven by rapid digital transformation. As firms embrace cutting-edge technologies and adapt to evolving regulatory landscapes, they are redefining efficiency and innovation.

This section explores the key trends and advancements propelling the industry forward, highlighting how companies are navigating these dynamic changes to thrive in a competitive global market.

Digital Transformation and Technological Advancements

The shift towards automation and data-driven decision-making has led to increased efficiency and accuracy in financial processes.

Key technological advancements driving this change include the adoption of cloud computing, artificial intelligence (AI), and blockchain technology.

Cloud Computing

Cloud computing has revolutionized the way financial data is stored, accessed, and managed. It offers scalable solutions that allow firms to handle vast amounts of data with greater flexibility and security.

Cloud platforms facilitate seamless collaboration among stakeholders, enabling real-time data sharing and analysis.

Artificial Intelligence (AI)

AI has become a crucial tool in the finance and accounting industry. It automates routine tasks, such as data entry and reconciliation, freeing up professionals to focus on more strategic activities.

AI-powered analytics can predict financial trends, identify anomalies, and provide actionable insights, enhancing decision-making processes.

Blockchain Technology

Blockchain technology ensures the integrity and security of financial transactions. By providing a decentralized ledger, it reduces the risk of fraud and enhances transparency. This technology is particularly beneficial for auditing and compliance, as it provides an immutable record of transactions.

The integration of these technologies has streamlined operations and improved data management. Firms can now process transactions more quickly and accurately, reducing the likelihood of errors. Enhanced data analytics capabilities allow for better risk assessment and mitigation strategies, ensuring compliance with regulatory requirements.

Shifts in Customer/Client Interactions

The rise of online banking and fintech solutions has significantly altered customer expectations. Clients now demand convenient and seamless experiences, prompting firms to prioritize digital transformation initiatives. This shift has led to the development of user-friendly platforms that offer 24/7 access to financial services, increasing customer satisfaction and loyalty.

Regulatory Environment Changes

In Malaysia, the regulatory environment for finance and accounting has become more stringent in recent years. There is a heightened emphasis on transparency and cybersecurity, with regulations increasingly aligned with international standards such as the Malaysian Financial Reporting Standards (MFRS) and International Financial Reporting Standards (IFRS).

Financial institutions and accounting firms must continuously adapt and adhere to these evolving regulations to remain compliant.

Innovative Financial Management Practices

A noticeable shift towards innovative financial management practices is evident in Malaysia, particularly in sustainability and environmental accounting. There is a growing emphasis on corporate social responsibility (CSR).

Research indicates that while CSR initiatives may not immediately impact profitability metrics like sales or return on assets (ROA), they significantly enhance corporate reputation and brand equity. This improved reputation can lead to increased stock returns and long-term financial performance.

Advancements in Financial Reporting and Data Analytics

Recent years have seen significant advancements in financial reporting and data analytics. Innovations in this area enable firms to analyse vast volumes of financial data in real-time, uncover hidden patterns, and generate actionable insights.

- Real-time data analysis: Real-time data analysis tools allow firms to make informed decisions swiftly, improving their competitiveness in the dynamic global economy.

- Cloud-based reporting solutions: Provide flexibility and accessibility, facilitating seamless collaboration among stakeholders regardless of their location.

- Interactive reporting tools: Empower stakeholders to visualize financial data and conduct ad-hoc analyses. This fosters transparency and collaboration, enabling better strategic planning and decision-making.

- Sustainability reporting tools: Sustainability reporting tools help firms assess their environmental, social, and governance (ESG) performance. These tools ensure that companies meet regulatory requirements and demonstrate their commitment to sustainable practices.

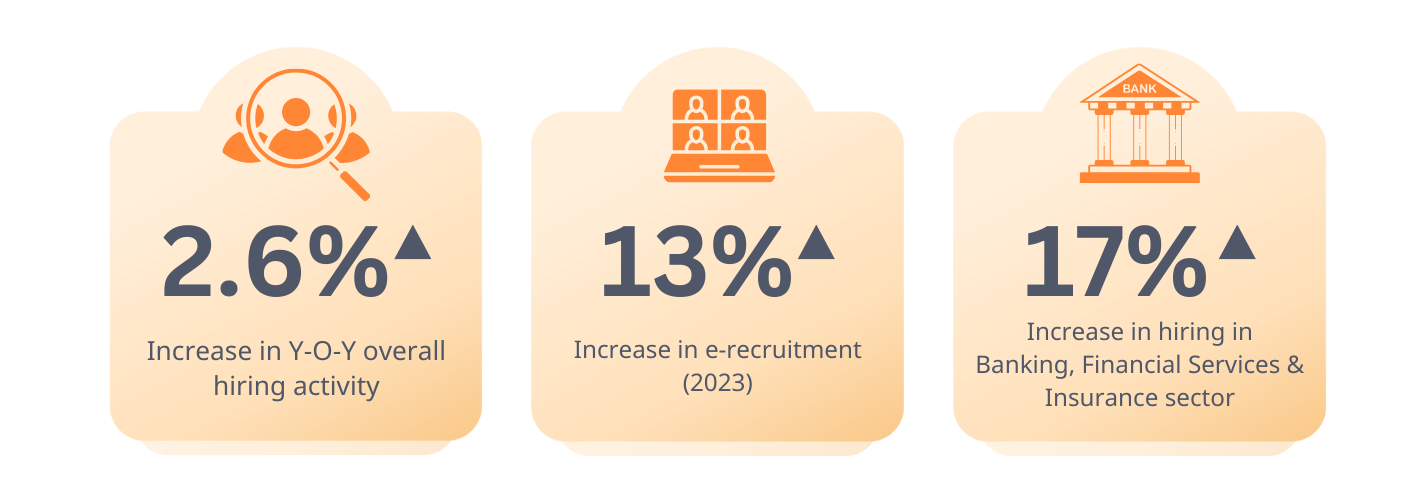

Current Job Market Insights

Malaysia’s job market has demonstrated remarkable resilience, with hiring activity inching up. With an emphasis on digital skills, there’s a growing demand for professionals with expertise in data analytics, financial modelling software, and emerging technologies such as blockchain and AI.

In-Demand Skills

Technical Skills

Soft Skills

- Communication: need to communicate complex financial information effectively

- Collaboration: need to be able to work with cross-functional teams

- Adaptability: need to be able to adapt to changing regulatory requirements and market conditions

Highly valued certifications/qualifications

- ICAEW certification

- ACCA (Association of Chartered Certified Accountants) qualifications

- CPA (Certified Public Accountant)

- CFA (Chartered Financial Analyst)

- CMA (Certified Management Accountant)

- Specialized certifications in areas such as:

- Financial modelling

- Risk management

- Internal auditing

In-Demand Roles

Emerging Roles

- Financial analysts: can analyse data and trends to provide insights for investment decisions

- Financial technology (fintech) specialist and digital banking managers: can navigate and innovate within the digital financial space

- Risk management professionals: can help companies navigate complex financial risks

Evolution of Finance and Accounting Sector Hiring Criteria in Recent Years

Soft Skills and Emotional Intelligence

Employers are placing greater emphasis on soft skills such as communication, adaptability, and problem-solving abilities. Emotional intelligence has also gained recognition for its importance in the workplace.

Candidates who demonstrate empathy, resilience, and the ability to work well in teams are highly valued, as these qualities contribute to a positive and productive work environment.

Remote Work Competency

The COVID-19 pandemic has accelerated the adoption of remote work arrangements, leading to a shift in hiring criteria. Employers now look for candidates who are comfortable with remote collaboration tools, possess strong time management skills, and can maintain productivity while working from home.

The ability to work effectively in virtual environments is a critical competency in the current job market.

Diversity and Inclusion

There is a greater emphasis on building diverse and inclusive workplaces. Hiring criteria now prioritize candidates from diverse backgrounds and with varied perspectives. Employers seek individuals who can contribute to a culture of inclusivity and bring unique viewpoints to the table, enhancing creativity and innovation within teams.

Career Advice for Jobseekers

Embrace Digital Skills and Adaptability

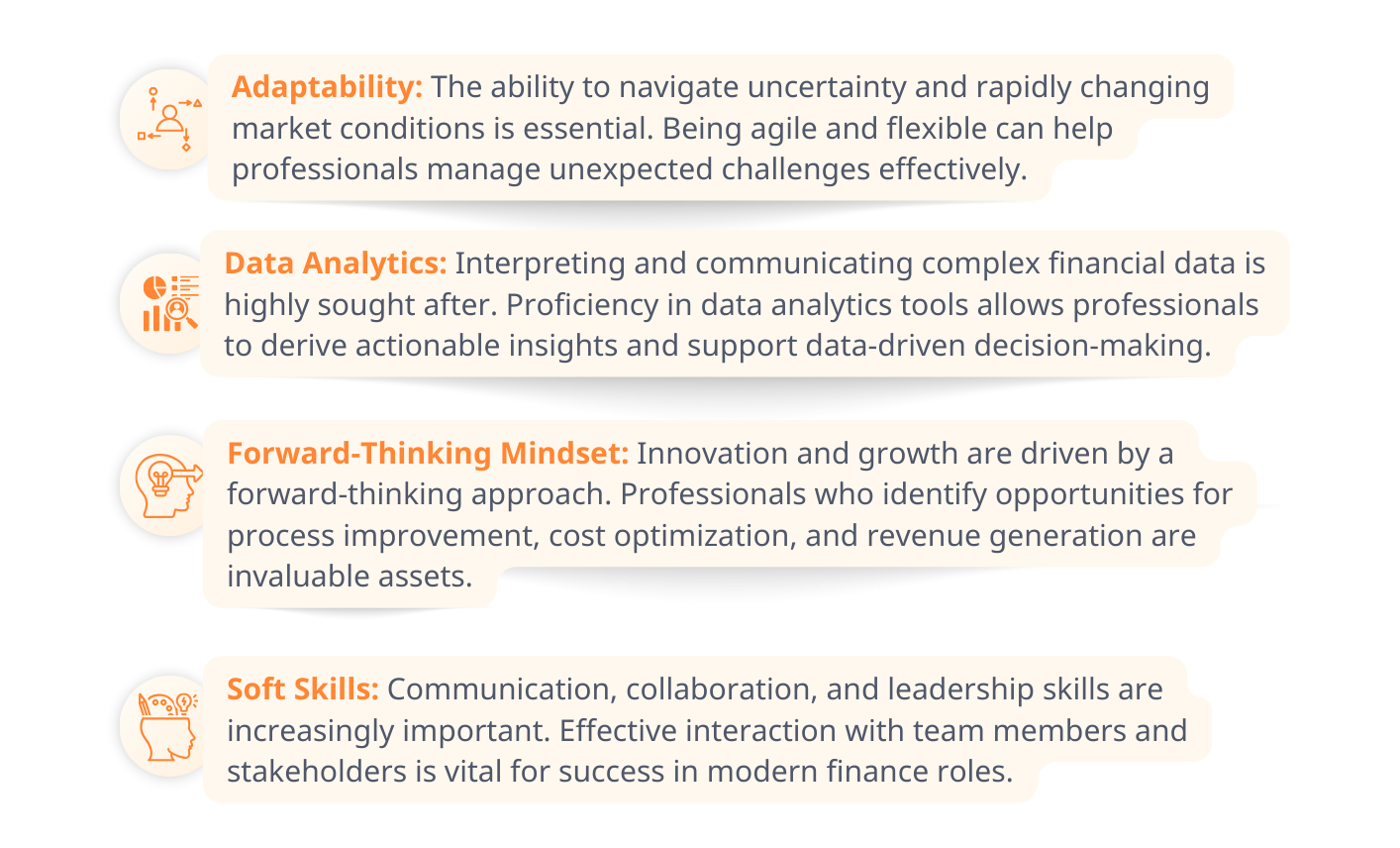

In the evolving Finance & Accounting sector, possessing strong digital skills and a willingness to adapt to new technologies will give candidates a competitive edge. Employers prioritize individuals who can seamlessly integrate traditional financial acumen with proficiency in digital tools and platforms, reflecting the industry’s dynamic nature. Continuous learning and adaptability are crucial as technological advancements reshape job roles.

Diverse Skill Set Requirements

Finance professionals are now expected to have a diverse skill set that extends beyond technical expertise. Key skills include:

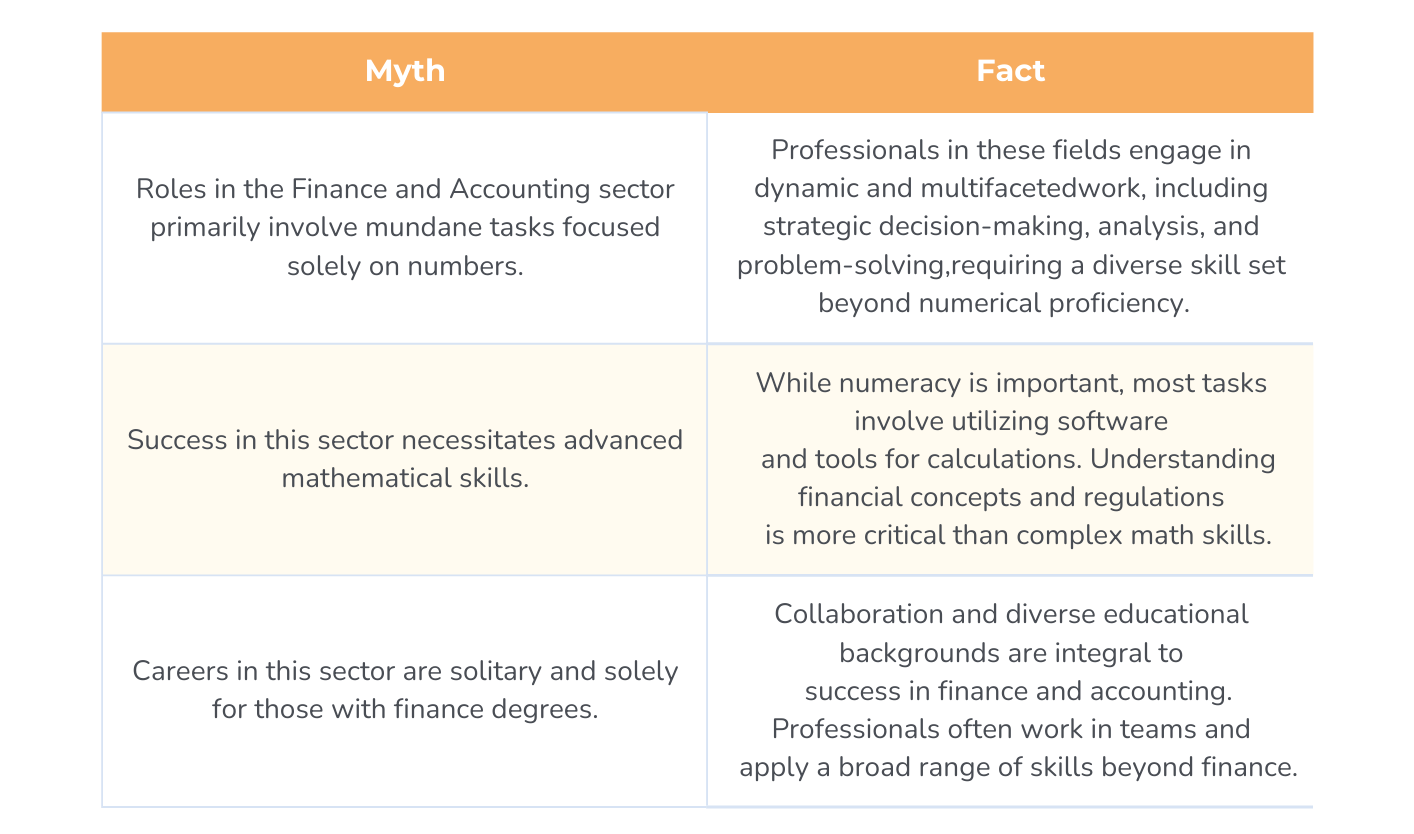

Common Misconceptions

Despite the dynamic and multifaceted nature of the Finance & Accounting sector, several common misconceptions persist about careers in this field. By debunking these myths, we can provide a clearer understanding of the diverse opportunities and skills required for success.